And insurance disputes are a common source of frustration and confusion for many people. For those claims that have been denied or for people who believe their carriers are acting in bad faith, knowing how to avoid these issues is vital. In this guide, you will learn how to discover and hire the best insurance denial lawyers including what is involved.

Can I Sue My Insurance Company for Emotional Distress?

The question often arises from people grappling with insurance disputes: can I sue for emotional distress? The quick answer is that, yes it can be done but not easily or graphed out in bullet points. In order to commence legal action against an insurance company for emotional distress, you need find that their actions are unusually harmful and have been the actual cause of your substantial psychological anxiety.

What Is Emotional Distress?

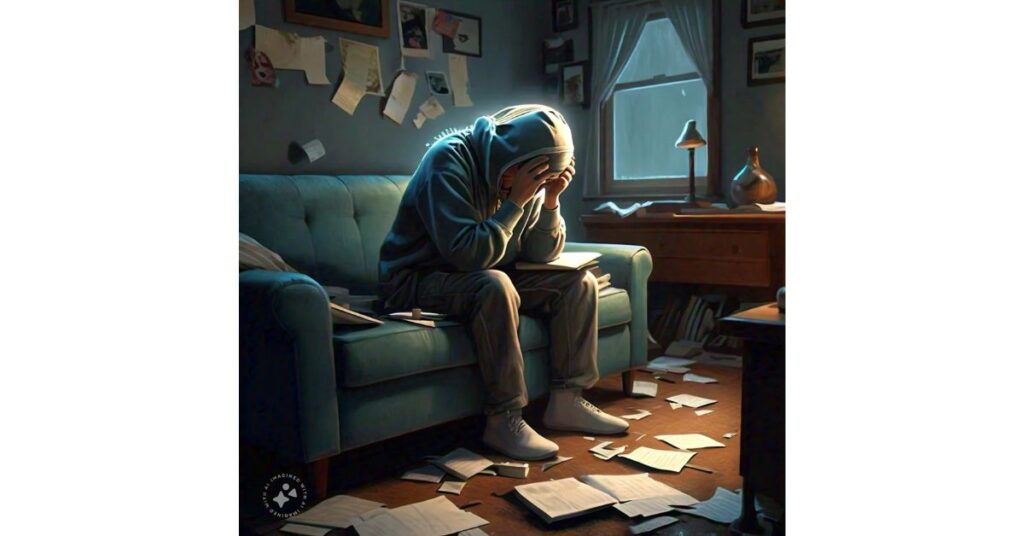

Suffering….all type of emotional distress that is a result for experiencing or have been submitted to stressing and damaging situations. This constitutes a variety of mental and emotional illnesses caused by the actions or inactions of others. It is the experience of feeling victimized by an insurance company as a result of its improper denial and/or handling (i.e., “bad faith”)-a frustration that can be typical during any contentious litigation, but especially so in disputes with your own insurer.

In the process you may encounter many variations of emotional distress commonly experienced such as;

Anxiety: Repeated and persistant concern or fear that a company may take your claim too long, threaten financial instability to career as you age;gende up in the employ with no income.

Depression: Persistent feelings of sadness, hopelessness and apathy regarding other day-to-day activities, typically linked to textbook examples pile up by months or years of stress let-down throughout the insurance process.

Sleeping problems: Your stress and emotional strain from the experience of having a dispute with an insurance company (this could be anything like not being able to sleep or insomnia, even nightmares.)

Loss of the Capacity for Enjoyment in Life: A diminution in one’s ability to enjoy all of those things that make life worth living, which can flow directly from what insurance companies put claimants through emotionally.

Demonstrating Emotional Distress

Showing of emotional distress in a legal claim requires proof that the actions taken by the insurance company have had caused you substantial harmemotionally. That means bringing in the proof that backs up your idea. Here are a few major components you might have to add:

Medical records – have professionals such as therapists and psychologists provide the required documents. This documentation should outline the injury caused to your mental health because of this, any diagnosis with a treatment plan and progress reports. There are medical records that objectively connect the insurance company’s actions to your pain and suffering.

Personal experience – specific details of how you have personally been impacted in your life and well-being This may include personal observations of how the emotional pain has affected your/your relationships and quality of life in general. Your personal testimony aids the court in understanding your pain and suffering, framing how you relate to an injury.

Testimonial Evidence: Support from people who have seen, and can attest to effects on your emotional state as a result of what the insurance company did to you. Thanks to these witnesses, you may obtain details on how your pain point has impacted the way in which others relate or go about their usual routine with and around.

Document everything: Take note of all communications with the insurance company – including letters, e-mails and phone calls. This can also be helpful to show the court how you were impacted emotionally with documentary evidence of what that company did or failed to do.

Consulting a Lawyer

Handling an emotional distress insurance claim against a major corporation can be overwhelming. This is where talking to a lawyer that deals specifically with emotional distress or insurance disputes comes in. How A Seasoned Attorney Can Assist

Consider Your Case: Seriously decide the viability of your emotional distress case, and find answers for whatever one evidential assay you may perform.

Accumulate Proof : Help in tracking the documents you need to support your claim: medical records and witness statements, for instance.

File a Claim: Take you through the legal process of filing a lawsuit and even represent your case in negotiation or court

Fight for Adequate CompensationListen Stop: demand that you receive a just settlement for the emotional distress.

A good attorney will help you to understand what rights and options are available for the claim of emotional distress.

Lawyers Who Sue Insurance Companies Near Me

You have a lot to gain from choosing the right lawyer locally. This article is for all those people who want to discover the attorneys and lawyers near me that sue insurance companies now, keep reading till end.

1. Online Search

The Local Attorneys: The internet is a very useful place to find local attorneys. How to Do Content Syndication right?

Directories and Reviews: Make sure that you take advantage of sites like Avvo, Martindale-Hubbell. These platforms provide:

Ratings and Reviews – The Lawyer; Look for their ratings, client reviews that will help you to understand the Reputation of a legal practitioner.

Insurance-Related Specialties: You can also look for lawyers who have a specialty in dealing with insurance-related disputes. That is where their experience matters for your case.

Law Firm Websites : Go to the sites of your local law firms. Look for:

R Browser Attorney Profiles Look through the profiles to view their experience, education and what areas insurance law they are especially proficient in

Areas of Practice: Verify the number one thing they do is insurance claims and disputes.

2. Recommendations

Among the most trusted ways of discovering a good attorney is by approaching your personal references Here’s how to leverage them:

3; Ask – Nepotism: Query your network to see if anyone has been in the same boat with insurance disputes and had a lawyer that they liked.

It called friends and professional contacts: Ask them to drop out of the drawer that has lived with insurance claims or good lawyers in this area.

That said, Word of Mouth is the #1 way to hire JURISolutions legal services staff because first-hand experience tells you much more about how a lawyer works and conveys itself – that online rating do not always convey.

3. Local Bar Association

They provide you with local bar associations to help in finding a good lawyer near your area. Here’s what you can do:

City or Country Bar Association: Contact the bar association in your city or country. These usually have referral services allowing you to be connected with insurance dispute attorneys.

Check Licensed Status – Knowing that the lawyer is licensed, and their bar association record follows will narrow down your search. They just separate the beginners from all others due to their bad attitude.

More Help: Free Legal Clinics Or Workshops Are Sometimes Offered By Bar Associations That Can Clarify Your Rights And May Put You In Touch With A Lawyer.

Suing Insurance Company for Denying Claim

An uninsured claim will require intervention by an attorney if your insurance company is denying a valid claim; What to Do When Suing an Insurance Company for Denying a Claim

1. Review the Denial

It is essential to understand why your claim was denied. Here’s how to proceed:

Review the denial letter: The reasons for the denial should be detailed in this letter. Look for:

Specific Driver: Determine whether the denial was a product of policy exclusions, procedural oversights, or other reasons.

Link the denial reasons to policy terms -Use this information with your policy terms if there are any discrepancies found.

Validate or Invalidate: based on your particular policy and what is in the claim process, decide if yes there would have been a real denial However, launching such an interrogation is a crucial step to take before going through other steps.

2. Appeal the Decision

Appeal before entering into litigation. This process involves:

Obtaining More Information: File new proof or documents with your argument. This might include:

Medical Records – may be updated records or additional forms of evidence not previously included

Witness Statements: These are simply any statements from other adults who can support what you say.

Filing For A Grievance: Send the insurance company a letter of complaint. In this letter:

Organize the Arguments : Be crystal clear as to why you think it is a claim that would be or should be granted.

Add Documents: uploads additional documents that prove your case

It’s best to document everything you do while appealing the denial – all communication with insurance company

3. Consult a Lawyer

If the appeal process fails or if your insurance company continues to be difficult, the next step is contacting an attorney. Here’s what to expect:

Be Educated About Your Legal Rights: An attorney will be able to explain your rights and potential legal grounds.

Analyze Legal Recourses: Talk about what and client can do legally, the possibility of successful claims as well as any possible outcomes.

Lawsuit: Finally, if necessary, your attorney can help you file a lawsuit to obtain the money owed to as compensation for damages. They will handle:

Legal Paperwork: Drafting and Filing All Required Court Documents

Court Representatives: Representing you in court for all hearings and trials.

And Selecting the Best Attorney: Choose an attorney who has a good track record of dealing with disputes in insurance claims. They will be extremely valuable in helping you navigate through the complicated legal process and protect your interests.

Suing an Insurance Company for Bad Faith

Suing an insurance company for bad faith is a serious legal action that involves claiming that the insurer acted dishonestly or unfairly in handling your claim. This kind of lawsuit is typically pursued when you believe that the insurance company has breached its duty of good faith and fair dealing. Understanding the nuances of this type of lawsuit is crucial if you’re facing issues with your insurance provider.

Understanding Bad Faith Practices

Bad faith practices occur when an insurance company fails to uphold its obligations to its policyholders. Here are some common examples:

1. Unreasonable Denial

Unreasonable denial happens when an insurance company refuses to pay a claim without a valid reason or fails to follow the terms outlined in your policy. This can include:

- Denying Coverage Without Justification: The insurer rejects a claim even though it clearly falls under your policy’s coverage.

- Ignoring Policy Terms: The insurer disregards specific provisions that should support your claim.

- Refusing to Pay Valid Claims: The company does not provide a reasonable explanation for not paying a claim that meets all the policy criteria.

For example, if you submit a claim for medical expenses related to a covered accident, and the insurance company denies it without a valid explanation or in contravention of policy terms, this could be considered an unreasonable denial.

2. Delay Tactics

Delay tactics involve the insurance company dragging its feet on processing your claim to avoid payment. This might include:

- Prolonged Processing Times: Taking excessive time to review or approve your claim, well beyond the typical processing period.

- Requiring Excessive Documentation: Continuously asking for additional documents or information that delays the resolution of your claim.

- Avoiding Communication: Not responding to your calls or emails in a timely manner, thereby stalling the claim process.

An example of delay tactics is an insurance company that takes months to approve a claim that typically should be resolved in a few weeks, causing unnecessary stress and financial strain.

3. Misrepresentation

Misrepresentation occurs when the insurance company provides false or misleading information about coverage or policy terms. This includes:

- False Statements About Coverage: The insurer inaccurately tells you that certain damages or losses are not covered under your policy when they actually are.

- Underpaying Claims: The company intentionally undervalues your claim to pay you less than what you’re entitled to.

- Misleading Information: Providing incorrect information regarding policy limits, exclusions, or how to file a claim.

For instance, if an insurance representative incorrectly informs you that your policy does not cover a particular type of damage, and you later find out that it does, this constitutes misrepresentation.

How to Prove Bad Faith

Proving bad faith requires demonstrating that the insurance company acted inappropriately in handling your claim. Here’s how you can build a strong case:

1. Demonstrating Malice or Gross Negligence

To prove that the insurance company acted with malice or gross negligence, you need to show that their conduct was intentionally misleading or excessively negligent. This might involve:

- Documenting Unfair Practices: Collect evidence showing that the insurance company engaged in unfair practices, such as consistently denying valid claims or using deceptive tactics.

- Proving Knowledge: Showing that the insurer was aware of the policy terms and deliberately chose to ignore or misrepresent them.

2. Showing Harm

You must also demonstrate that you suffered harm as a result of the insurance company’s bad faith conduct. Harm can be:

- Financial Loss: The denial or delay of your claim led to financial hardship, such as unpaid medical bills or repairs.

- Emotional Distress: The stress and anxiety caused by the insurance company’s actions impacted your mental well-being.

Gathering evidence such as financial records, medical bills, and documentation of emotional distress can support your claim.

Legal Action

If you believe you have a valid case for bad faith, consulting with a lawyer who specializes in bad faith insurance cases is crucial. Here’s what to expect:

1. Gathering Evidence

A lawyer will help you gather and organize all necessary evidence to support your claim, including:

- Policy Documents: Your insurance policy and any correspondence related to your claim.

- Communication Records: Emails, letters, and notes from phone calls with the insurance company.

- Financial Records: Proof of financial loss or additional expenses incurred due to the bad faith practices.

2. Filing a Lawsuit

If your claim cannot be resolved through negotiation or mediation, your lawyer will assist you in filing a lawsuit. This process typically involves:

- Drafting and Filing a Complaint: Your lawyer will prepare a legal complaint outlining your claims and file it with the appropriate court.

- Representing You in Court: Your lawyer will present your case, argue on your behalf, and provide evidence to support your claims during the trial.

- Seeking Damages: Your lawyer will work to secure compensation for any financial losses, emotional distress, and potentially punitive damages.

Suing an insurance company for bad faith is a complex process that requires clear evidence and skilled legal representation. If you suspect that your insurer has acted in bad faith, consult with an experienced attorney to discuss your case and explore your legal options. With the right support, you can hold the insurance company accountable and seek the compensation you deserve.

Can You Sue an Insurance Company for Taking Too Long?

Dealing with delays in processing your insurance claim can be incredibly frustrating. You might find yourself asking, “Can you sue an insurance company for taking too long?” The short answer is yes, but it depends on the specifics of your case. If the delay is excessive, unreasonable, and has caused you significant harm, you may have grounds for legal action.

What Constitutes Unreasonable Delay?

Understanding what constitutes an unreasonable delay is crucial for determining whether you have a valid claim against your insurance company. Here are some key factors that define an unreasonable delay:

1. Fails to Meet Deadlines

Insurance policies usually specify time frames within which claims should be processed and settled. These deadlines are often outlined in the policy documents and can include:

- Initial Claim Processing Time: The time within which the insurer should acknowledge receipt of your claim and start the review process.

- Investigation Period: The duration within which the insurer must conduct an investigation and make a decision on your claim.

- Payment Time: The time frame for issuing a payment after a claim has been approved.

If the insurance company fails to adhere to these deadlines, it may be considered an unreasonable delay. For example, if your policy states that claims should be processed within 30 days, but it has been 60 days with no resolution, this could be deemed unreasonable.

2. Does Not Provide Updates

Regular communication is a key part of the claims process. Insurance companies are generally expected to keep you informed about:

- The Status of Your Claim: Updates on the progress of your claim and any additional information required.

- Next Steps: Information about what to expect next in the process.

If the insurance company does not provide timely updates or fails to respond to your inquiries, this lack of communication can contribute to the perception of an unreasonable delay. For instance, if you’ve made multiple follow-up calls or sent emails without receiving any response, this may indicate poor handling of your claim.

3. Prolonged Investigation Periods

In some cases, delays are caused by prolonged investigations. While some complex claims may require more time, an extended investigation without clear reasons or progress can be problematic. The insurance company should justify why a delay is necessary and how it is actively working on resolving the claim.

4. Administrative Errors

Administrative errors or inefficiencies within the insurance company can also lead to delays. Examples include:

- Lost Documents: Misplacing important documents or information that causes delays in processing.

- Internal Miscommunication: Poor coordination among different departments handling your claim.

Steps to Take

If you believe your insurance company’s delay is unreasonable, here are steps to address the issue:

1. Document Delays

Maintaining thorough records is essential for proving that a delay has occurred. Here’s what you should document:

- Communication Records: Keep copies of all correspondence with the insurance company, including emails, letters, and notes from phone calls.

- Dates and Times: Record the dates and times of each interaction and the nature of the communication.

- Response Times: Note how long it takes for the insurance company to respond to your inquiries or requests for updates.

Having detailed documentation will support your case if you decide to take legal action.

2. Review Your Policy

Check your insurance policy to understand the deadlines and requirements for processing claims. This will help you determine if the insurance company is failing to meet its contractual obligations.

3. File a Formal Complaint

Before pursuing legal action, consider filing a formal complaint with the insurance company. This step often involves:

- Submitting a Written Complaint: Outline the issues you’ve encountered, including the delays and lack of communication.

- Requesting a Resolution: Ask the insurance company to address the problem and provide a timeline for resolving your claim.

4. Consult a Lawyer

If the insurance company does not resolve the issue satisfactorily, consulting with a lawyer is advisable. An attorney specializing in insurance disputes can:

- Evaluate Your Case: Assess whether the delay constitutes grounds for legal action based on your policy terms and the extent of harm caused.

- Provide Legal Advice: Offer guidance on the best course of action, whether it’s negotiating with the insurance company or filing a lawsuit.

- Represent You in Court: If necessary, represent you in legal proceedings to seek compensation for any damages incurred due to the delay.

5. Consider Regulatory Agencies

If you are unable to resolve the issue through the insurance company or legal means, you may also consider filing a complaint with a regulatory agency. In many jurisdictions, there are state or national insurance regulatory bodies that oversee insurance practices and can investigate complaints.

How Much Can You Sue an Insurance Company For?

When you decide to take legal action against an insurance company, one of the most critical questions is “How much can you sue an insurance company for?” The amount you can potentially recover depends on several factors, including the nature of your claim, the extent of your damages, and the specifics of your insurance policy. Let’s break this down:

1. Types of Damages You Can Claim

a. Compensatory Damages

Compensatory damages are designed to compensate you for actual financial losses and harm directly related to the insurance company’s wrongful actions. These include:

- Economic Damages: These cover tangible losses such as medical bills, lost wages, repair costs, and other expenses incurred due to the insurance company’s actions. For example, if your claim was wrongfully denied, leading to unpaid medical bills, you can sue for these costs.

- Non-Economic Damages: These address intangible harm such as pain and suffering, emotional distress, and loss of quality of life. Non-economic damages are harder to quantify but are essential in cases where the insurance company’s actions have significantly impacted your well-being.

b. Punitive Damages

Punitive damages are awarded in addition to compensatory damages and are intended to punish the insurance company for particularly egregious conduct and deter similar behavior in the future. These damages are not automatically granted and are typically awarded when the insurer’s actions are found to be particularly malicious or reckless.

2. Policy Limits

The amount you can claim may be restricted by the terms of your insurance policy. Insurance policies often have limits on the amount they will pay out for various types of claims. Understanding these limits is crucial in estimating the compensation you can pursue.

a. Review Your Policy

Carefully review your policy to understand the coverage limits and exclusions. Pay attention to:

- Coverage Limits: Maximum amounts payable for different types of claims (e.g., bodily injury, property damage).

- Deductibles: Amounts you are responsible for paying before the insurance company covers the rest.

- Exclusions: Specific situations or types of damage not covered by the policy.

b. Consult a Lawyer

To get a clear picture of your potential compensation, consult with a lawyer who specializes in insurance disputes. They can:

- Evaluate Your Policy: Help you understand how the policy limits affect your claim.

- Estimate Potential Compensation: Provide an estimate based on your damages and policy terms.

Suing Insurance Company for Car Accident

If your insurance company mishandles a car accident claim, you may need to consider suing an insurance company for car accident issues. This process involves several key steps:

1. Claim Denial

If your claim for a car accident is denied, despite being valid, legal action might be necessary. Here’s how to approach this situation:

a. Review the Denial

Understand the reasons behind the denial. Common reasons include:

- Insufficient Evidence: The insurance company might claim there isn’t enough evidence to support your claim.

- Policy Exclusions: The denial might be based on exclusions in your policy.

- Fault Disputes: The insurance company might dispute who was at fault for the accident.

b. Appeal the Denial

Before taking legal action, attempt to resolve the issue through the appeals process. This involves:

- Gathering Additional Evidence: Provide any new documentation or information that supports your claim.

- Submitting an Appeal: Write a formal appeal letter outlining why the denial was incorrect and include supporting evidence.

c. Legal Action

If the appeal is unsuccessful, you may need to pursue legal action. Consult with a lawyer to discuss:

- Grounds for a Lawsuit: Determine if the denial was a breach of contract or bad faith.

- Possible Remedies: Explore potential remedies and compensation available.

2. Low Settlement Offers

Sometimes, insurance companies offer a settlement that is significantly lower than what you are entitled to. If you receive a low settlement offer, consider the following steps:

a. Evaluate the Offer

Assess whether the offer covers all your damages, including:

- Medical Expenses

- Property Damage

- Lost Wages

b. Negotiate

Negotiate with the insurance company to reach a fair settlement. Present evidence supporting your claim and demonstrate why the initial offer is insufficient.

c. Legal Representation

If negotiations fail, consider suing the insurance company. A lawyer can:

- Advocate for Fair Compensation: Represent you in negotiations or court to secure a fair settlement.

- Handle Legal Procedures: Manage the legal process, including filing a lawsuit and presenting your case.

Legal Advice

Consult a Lawyer who specializes in car accident claims to handle your case effectively. They can:

- Provide Expertise: Offer guidance on the best approach to take, whether through negotiation or litigation.

- Ensure Fair Compensation: Work to ensure you receive the compensation you deserve for your damages and losses.

Can You Sue Your Insurance Company for Pain and Suffering?

Yes, in certain circumstances, you can sue your insurance company for pain and suffering. This typically applies when the actions or inactions of the insurance company have led to significant emotional or physical distress beyond what is covered by standard policy terms.

Understanding Pain and Suffering

Pain and suffering refer to the physical and emotional distress that results from an injury or prolonged claim dispute. In the context of insurance disputes, this can include:

- Emotional Distress: Anxiety, depression, and other psychological impacts.

- Physical Pain: Chronic pain or discomfort related to the denied claim or mishandling of your insurance.

- Loss of Enjoyment: Difficulty enjoying activities or hobbies you once loved.

Proving Pain and Suffering

To successfully claim pain and suffering from your insurance company, you need to provide compelling evidence. Here’s how you can substantiate your claim:

1. Medical Records

Medical records are crucial for proving pain and suffering. They should include:

- Diagnoses and Treatment: Documentation of any medical diagnoses related to your distress, such as mental health conditions or physical injuries.

- Therapist or Counselor Notes: Notes from mental health professionals detailing the impact of the insurance company’s actions on your emotional state.

- Prescription Records: Evidence of any medications prescribed for pain or psychological distress.

2. Personal Testimony

Personal testimony involves describing how your pain and suffering have affected your life. This can include:

- Detailed Accounts: Written descriptions or oral testimonies about how your daily life has changed due to the distress caused by the insurance company’s actions.

- Impact on Relationships: How your distress has affected your relationships with family and friends.

- Loss of Enjoyment: Examples of how your ability to engage in activities you once enjoyed has been diminished.

3. Documentation of Impact

Collect evidence showing the broader impact of your pain and suffering:

- Work Records: Proof of lost wages or reduced work performance due to your distress.

- Social Impact: Changes in your social life or community involvement as a result of your condition.

Legal Support

Navigating a claim for pain and suffering requires expert legal guidance. Here’s why legal support is essential:

1. Expertise in Personal Injury Cases

A lawyer with experience in personal injury cases, particularly those involving insurance disputes, can:

- Evaluate Your Claim: Assess the strength of your case and the likelihood of success.

- Gather Evidence: Help you collect and organize the necessary evidence to support your claim.

- Negotiate Settlements: Advocate on your behalf to negotiate fair compensation from the insurance company.

2. Navigating Legal Procedures

Legal procedures for pain and suffering claims can be complex. An experienced lawyer will:

- Guide You Through the Process: Explain each step of the legal process and what to expect.

- Prepare Legal Documents: Ensure all legal paperwork is completed accurately and submitted on time.

- Represent You in Court: If necessary, represent you in court to argue your case effectively.

Finding the Right Lawyer

Choosing the right lawyer is crucial for a successful claim. Consider these factors:

1. Experience

Look for a lawyer with substantial experience in handling insurance disputes and personal injury cases. An experienced lawyer will:

- Understand Complex Insurance Issues: Be familiar with the nuances of insurance law and dispute resolution.

- Have a Track Record of Success: Demonstrate a history of successful cases similar to yours.

2. Specialization

Select a lawyer who specializes in the type of claim you are pursuing. This ensures they have:

- Focused Expertise: Deep knowledge of the specific legal issues related to pain and suffering claims.

- Effective Strategies: Proven strategies for handling similar cases.

3. Local Knowledge

A lawyer familiar with local laws and regulations can provide:

- Understanding of State-Specific Rules: Knowledge of the legal landscape specific to your jurisdiction.

- Connections with Local Experts: Access to local medical and psychological experts who can support your case.

Consultation and Representation

When meeting with potential lawyers:

- Discuss Your Case: Share details about your situation and ask about their experience with similar claims.

- Ask Questions: Inquire about their approach, fees, and how they plan to handle your case.

- Review Client Testimonials: Look for reviews and testimonials from previous clients to gauge their satisfaction and the lawyer’s effectiveness.

Legal support is crucial when pursuing a claim for pain and suffering. With the right lawyer by your side, you can effectively navigate the process and seek the compensation you deserve.

My Car Was Hit and Their Insurance Won’t Pay: What to Do Next

Sales Tax Compliance Outsourcing for Business Startups

Conclusion

Suing an Insurance Company Can Be Complicated and Intimidating When It Comes to the Legal Process If you are dealing with denied claims, delays, or rejecting emotional trauma while claiming the insurance company and ensure they pressurize to payment quickly. First thing is figuring out why you should sue for those reasons when choosing a Lawyerera.

Accepting Why You Are Suing

You must also be clear on the reasons as to why you are filing a lawsuit against his employer, before proceeding with your legal attempts. Common reasons include:

If anyone says CLAIM DENIAL: If your claim has been denied it could be due to mistake or misreading on the policy explanations.

Bad Faith: If you want to sue for bad faith, meaning the insurance carrier has not acted honestly or fairly with their dealing/s and treating of your case(s), then it must be proven by competent evidence that they operated in Bad Faith.

Lost Sleep: Supporting every claim with emotion will not win the case, but when you can show that your lost sleep affects the workplace or make it difficult for each day to function properly, make sure information supports these claims.

Unpaid Payments: You would need to show that the company is abusing payment and putting their commercial problems on you * Delayed Payments: If it takes too long for claims of yours, other than showing this delay took more than reasonable amount of time there must a proof how such late harmed you.

Finding the Right Lawyer

Having the right attorney is key to guiding your case through within reason. Some of the guidelines to select a good legal counsel is :

Specialized practice: Find a lawyer who specializes in insurance dispute cases and have been involved with similar matters that you face. If the legal issues are not common, you will obviously want a lawyer who is familiar with how to address your specific concerns.

Reputation: To get more information on the lawyer, read testimonials from clients as well track record and professional achievements. A quality lawyer who has been successful in good to great cases, generally will be better at defending you.

Local Expertise: A local attorney who is knowledgable about the legal framework in your region can give you an edge. They are educated in the differences of your jurisdiction and can move more nimbly within local court systems.

Consulting the Law Firms Dominion with Experience

Also avoid firms like The Barnes Firm or Reich & Binstock. These companies have handled high-value insurance disputes; you can find their experience and benefits:

Fully Focused Legal Advocacy: They offer a comprehensive protection of all rights beginning at the time you consult with them up until your case is closed.

Skill and experience: These law firms have been appointed for several years fighting with the insurance companies will give them expertise required to manage your case.

Taking the Next Steps

You may have a strong liability case and require too much professional legal help then do not hesitate to call our office for your free consultation. In such a session, you will:

Tell Your Story: Give more information about your case for an evaluation of things that can or cannot improve the chances.

Understand the legal tactics that might be available for your case and what this can mean for you.

Decide with more clarity and select a solicitor which who best serves your needs.

Proactively seeking the advice of experienced lawyers can make a substantial difference in what happens to you. Nevertheless, by learning about your legal rights and hiring an experienced attorney to represent you in Pennsylvania, the odds of obtaining a positive settlement offer and ultimately collecting money for damages are very good.